Sunday, January 13, 2013

Topics: Parents Just Don't Understand

We're always trying to put Brooklyn's boom in perspective for people because, in some ways, it's a pretty shocking phenomenon making new leaps & bounds what seems like everyday. Yet it other ways it's a total no-brainer that's chugging along proportionally to everything else that's going on.

Imagine our surprise writing that first rent check of over $750/BR for something the size of a closet in a 3BR share in the hood 10 years ago. Just a few years later, brownstones in that hood were pushing $2M. When each floor rents for more than the mortgage on a $500K loan, and you've got 4 of those floors... well, you do the math. If you've ever spent time searching in the $700K condo game in the coveted areas of Brooklyn, you might have a sense of how hard it is to find even one floor for $700K. So what's with the shock & awe when 4 floors of what's easily $700K per floor amounts to $2M or more for the entire building?

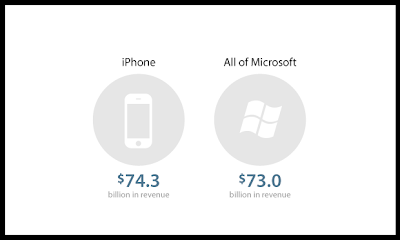

Once upon a time, not even 15 years ago, families all over the country crowded around ~$600 Trinitron televisions and considered that pretty decent technology. Yet within a decade, people were spending $2,000+ on flatscreen TV's, and the entire fam' (down to the 12 year old niece!) had $600+ phones in their pockets. We went from one $600 TV for the whole family to a collection of $600 phones for the whole family. So it's no surprise that companies making those $600 phones like Apple starting making crazy money. So much so that it was recently reported that Apple's iPhone business alone surpassed the entire revenue of Microsoft:

Apple's stock price seemed high to some when it was in the $200's before and after the crash. It sits above $500 today (and has been much higher). Yet, even at those levels, its p/e ratio is still an extremely modest 11-12 times earnings. Compare that to Amazon, a "cheaper" stock than Apple by share price at some $260+, but with a p/e of over 3,000 times earnings. If Apple stock was trading at the same p/e as Amazon, one share of Apple would cost $150,000 instead of $500.

"What does any of this have to do with Brooklyn?" you might ask. Well, accordingly, if only a handful of years ago rentals could still be found in Bed-Stuy and Crown Heights for $500-$600/BR, and those numbers have doubled for renters... just guess what the sales prices have done? Have they doubled? Not quite. But that wouldn't've been any surprise. In that climate, how steep is the leap from a $750K purchase price to $1M, or even $1M to $1.25M, when $250K financed at prevailing rates is barely over $1,000 more a month on your loan? Which is why it's a little odd to still wake up to e-mails everyday from folks making tens of thousands of dollars a month, boldly telling us what's too expensive in Brooklyn. People casually hate on and refuse to pay market prices for houses that cost less than their year-end bonuses. We're still moving 4-story brick & brownstone townhomes for under $1.5M (sometimes half that) in neighborhoods with escalating rents and plenty of gentrification room to run. And that's all for the price of a dinky condo in Manhattan - or even just condos in "better" parts of Brooklyn. Just some food for thought.

Subscribe to:

Post Comments (Atom)

No comments:

Post a Comment